The Vision of the Sonrisa Villas Project

Town of Xcalak

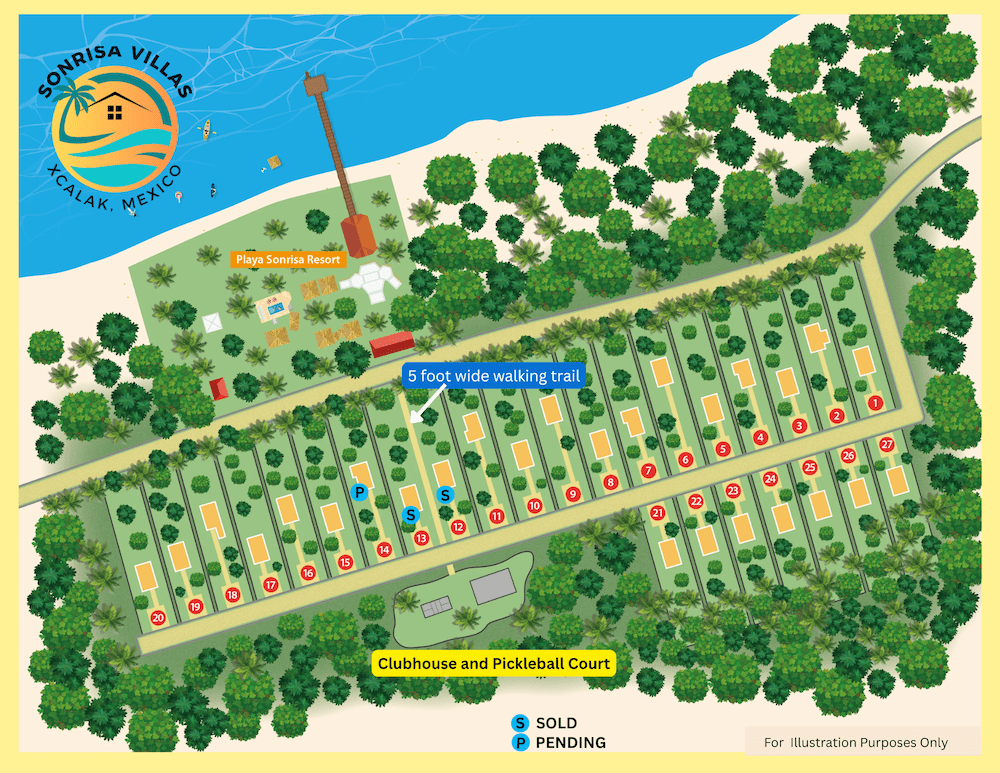

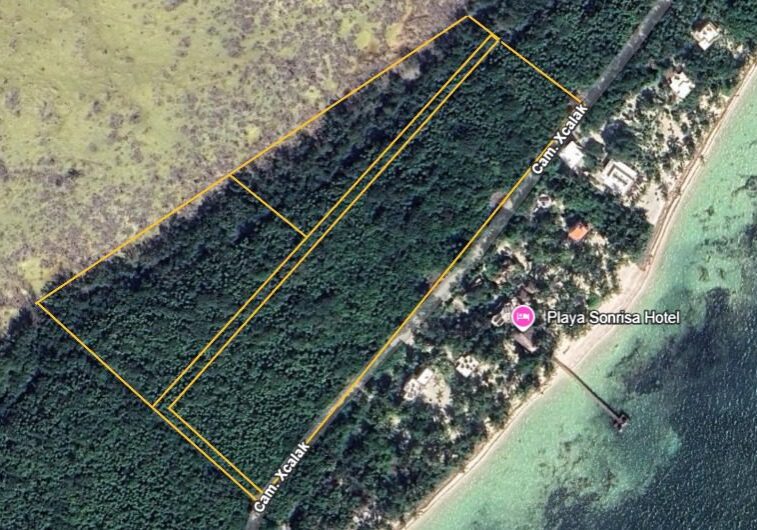

Sonrisa Villas Location

At Sonrisa Villas, we believe our naturist community represents more than just a development — it’s an opportunity to uplift the entire town of Xcalak while preserving its quiet charm and natural beauty.

We are deeply committed to creating a place that harmonizes with the local culture and environment, supporting the people who make this area so special. Every new home and visitor will help sustain local jobs — from the groundskeepers, housekeepers, and restaurants to the town tiendas, fishermen, and snorkeling guides and don't forget the fruit trucks, water bottle and propane delivery, and even the trash pickup guys, who will all benefit from the Sonrisa Villas Community.

By keeping Sonrisa Villas a naturist-friendly destination, we’re attracting respectful, environmentally conscious travelers who value simplicity, connection, and nature.

Together, this community will help strengthen Xcalak’s economy while protecting its authenticity and the relaxed, open spirit that makes it unlike anywhere else in the world.

FREQUENTLY ASKED QUESTIONS

That’s an option! Our Home Purchase with Flexible Financing plan offers a simple and affordable path to owning a Caribbean home in Sonrisa Villas, Xcalak — without needing to join the Pre-Construction Purchase Program.

Here’s how it works:

-

Starting Price: From $200,000 USD, including a ¼-acre (+/-) lot and a newly built home.

-

Deposit: Secure your lot today with just $10,000 USD.

-

Flexible Terms:

-

No credit check required

-

Interest-free payments for 12 months

-

After 12 months, remaining balance may be financed with us via a 5-year balloon note

-

Or you can arrange your own outside financing if you prefer

-

-

Construction begins once 60% of funds are received and permits are approved.

🎁 Early Buyer Bonus:

The first 5 buyers will receive a brand-new 4-wheel ATV and a private garage — a $10,000 USD value — as a thank-you for being part of our founding group of owners.

It’s a straightforward, flexible way to make your naturist lifestyle dream home a reality in Xcalak.

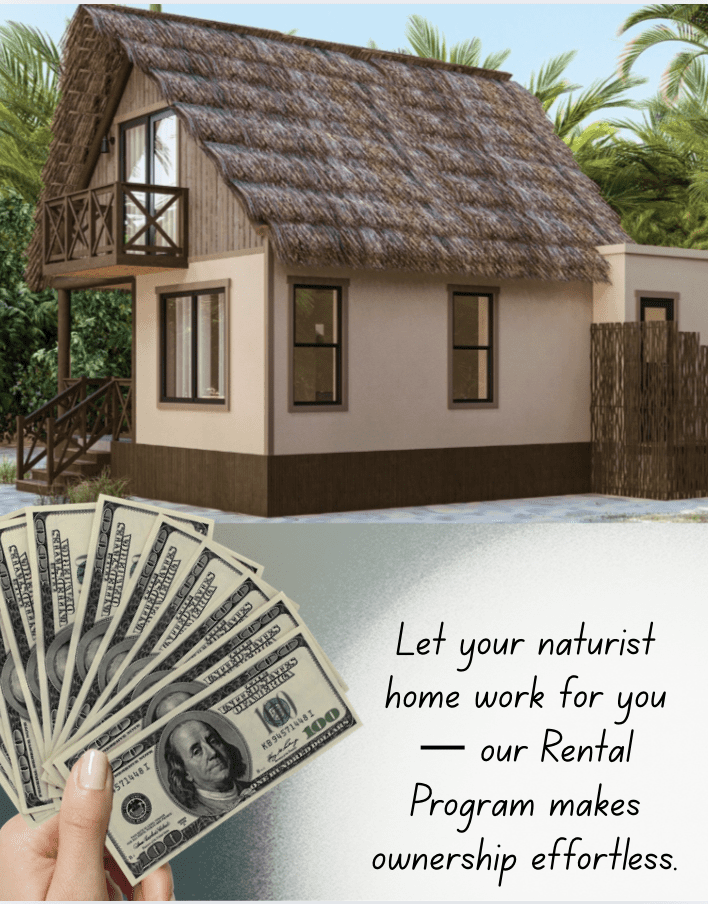

Yes! Sonrisa Ventures offers a complete leasing and property management program through Playa Sonrisa Resort. When you’re not using your home, our team takes care of everything — from marketing and guest bookings to housekeeping and on-site guest services — ensuring your home stays clean, secure, and ready for each arrival.

Many owners choose to make their homes available for select weeks or months each year to help offset ownership costs such as HOA fees and maintenance.

While Sonrisa Villas does not guarantee or imply any financial return, similar eco-style vacation homes in the Costa Maya region typically rent between $300 and $500 USD per night, depending on size, amenities, and season. These figures are shared only as illustrative examples based on local market trends.

All rental activity is handled exclusively through the Playa Sonrisa Booking Program, maintaining high service standards and preserving the integrity of our naturist community. A management commission is applied to cover marketing, guest care, cleaning, and property oversight, with the net amount paid directly to the homeowner after each stay.

Example of How the Rental Program Could Work

Here’s an illustrative scenario of how the Playa Sonrisa Rental Program might operate:

-

Home rents for $400 USD per night

-

Occupied for 12 weeks (84 nights) per year

-

Gross rental revenue: 84 × $400 = $33,600 USD

-

Less 50% management commission: $16,800 USD

-

Net to owner: approximately $16,800 USD per year (before taxes or HOA fees)

This is for demonstration purposes only — actual results will vary depending on occupancy, guest demand, and seasonality.

Disclaimer: The information above is for illustrative purposes only and does not constitute a guarantee of rental income, appreciation, or financial return. Actual results may differ based on market conditions, owner participation, and management service level.

Yes — foreigners can own property in Mexico, including in coastal areas like Xcalak — but because Xcalak is within what’s called a “restricted zone” (close to the coast), there are additional legal mechanisms required.

Here are the essentials:

-

The Mexican Constitution (Article 27) defines that foreigners cannot directly own land within the “restricted zone” (which is typically land within 50 km of the coast or 100 km of an international border). Xcalak Mexico+5Consulado Mexicano+5Taxes for Expats+5

-

Xcalak is located on the Caribbean coast in Quintana Roo, so it falls within that restricted zone.

-

In such restricted zones, the common legal route for a foreign individual buying residential property is via a bank trust (fideicomiso), or through a Mexican corporation in certain commercial cases.

So yes, you can buy, but you’ll need to use one of the appropriate legal structures,

A notario público (a specialized public notary) will handle the formal transaction, registration, etc.

-

Establish a fideicomiso (bank trust) with a Mexican bank: you as beneficiary, bank holds the title as trustee. This gives you rights to use, rent, improve, sell, inherit.

-

The trust term is typically 50 years and can be renewed.

-

Alternatively, if the purpose is commercial (e.g., you’re buying a property to run a business), you may set up a Mexican corporation, which can own property directly in some cases.

Transfer and register title

- The notario will register the property in the Public Registry in your name (or trust name) and handle applicable taxes and fees.

Pay ongoing costs and maintenance

-

Annual bank trust fees (if fideicomiso), property tax (predial), utilities, etc.

Typical Costs: (Note: these are ball-park estimates from recent sources; actual costs vary by bank, region, property value, and complexity.)

Initial setup / one-time costs

-

Setting up the trust with the bank + administrative/legal filings: around US $700-US $3,000.

Annual maintenance / ongoing costs

-

After the trust is established, you’ll pay yearly trustee/bank fees: common range is about US $500-US $1,000 per year.

- Closing-costs for the bank trust fees could equate to roughly 0.5%-1% of the property value annually (as a rule of thumb) in some areas.

Typical Closing Costs Breakdown for the Buyer

Here are the major categories of costs and approximate amounts:

-

Acquisition / property transfer tax (Impuesto Sobre Adquisición de Bienes Inmuebles ISAI / similar)

Typically ~ 2%–4% of the purchase price, depending on state. -

Notary public fees (Notario Público services, document preparation, certification, registration)

Often ~ 1%–2% of the purchase price, sometimes more depending on value and complexity. -

Public registry / title registration fees

Fees to record the deed and update public records—often in the range of ~0.2%–0.5% of value, plus flat administrative fees. -

Appraisal / valuation / certificate of no liens / other certificates

These are smaller relative amounts but still part of closing costs. For example, appraisal may cost ~0.1%–0.5% of value. -

Miscellaneous administrative fees

E.g., issuing “certificate of freedom of liens”, transferring utilities, obtaining proof of payment of property taxes, etc. These may be flat and smaller relative to big costs.

Typical Overall Percentage to Budget

-

Many sources recommend budgeting ~5% to 8% of the purchase price for closing costs (excluding fideicomiso setup).